If you’ve never processed payroll, you might be feeling a little intimidated. But don’t worry. Processing payroll is easier than you think. This guide will take you through the payroll process step by step, so you’re confident and prepared for payday.

Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic.

What is payroll processing?

Payroll processing is the act of managing employee payments. It covers everything from inputting an employee into your payroll software to giving them their paychecks.

If you’re a small business owner, chances are good you’re the one handling payroll. When your team gets bigger and payroll becomes more time-consuming, you might hand off this task to an accountant or HR manager.

Often, business owners purchase a payroll accounting software to help with organization and ensure payroll compliance with state and federal laws. There are a lot of taxes to keep in mind when processing payroll, so it helps to have professional assistance.

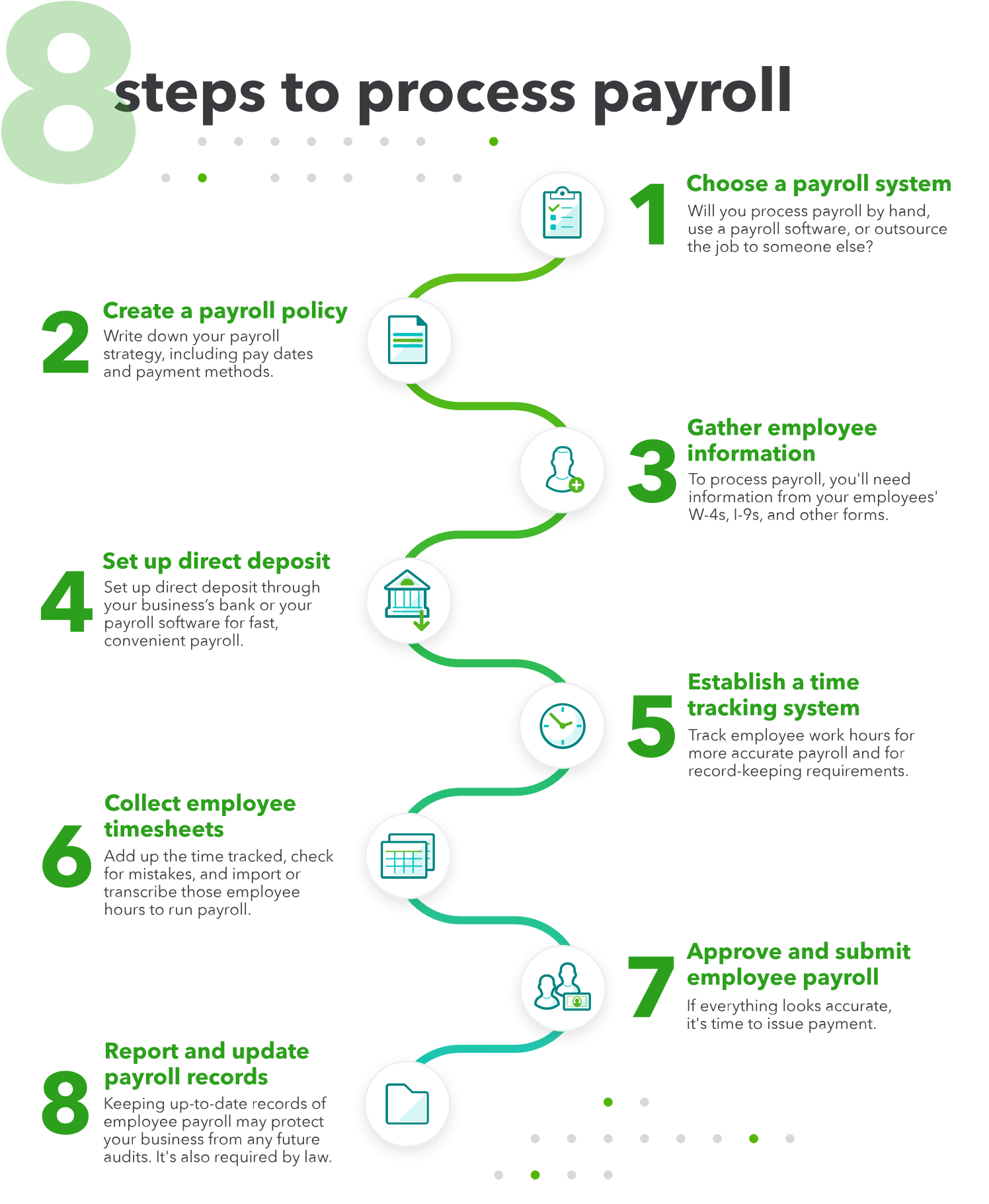

If you’re wondering how processing employee payroll works, there are eight basic steps from start to finish.

How to process payroll – step by step

Processing payroll isn’t just about compensating your employees. It’s part of operating your business legally—according to state laws and the Fair Labor Standards Act (FLSA). The FLSA has several requirements that fit into your payroll process—from tracking employee time at work to recordkeeping. You’ll want to keep those regulations in mind when establishing a payroll process.

1. Choose a payroll system

There are three basic payroll systems: manual payroll, outsourced payroll, and payroll software.

- Manual payroll is processed by hand, typically on paper or in a spreadsheet.

- Outsourced payroll means hiring someone else to take care of everything from payroll taxes to bookkeeping.

- Payroll software varies by plan or product. Most offer everything from basic payroll assistance to additional payroll services that may include time tracking or even HR services.

Before you commit to one system over another, consider factors like business growth, employee benefits, and the complexity of your state’s payroll taxes and laws. The more complicated the components and calculations, the more likely it is you’ll want to purchase a payroll software or outsource payroll altogether.

2. Create a payroll policy

Before you create a payroll policy, review your local labor laws, state overtime laws, and federal labor laws. The most common FLSA violation is unpaid overtime, which can happen by accident when you don’t know the rules.

Here are some other things to include in your payroll policy:

- Pay dates, including the length of each pay period, and when you pay employees after that.

- How you’ll pay employees—by direct deposit or paper check.

- Payroll deductions and withholdings and how the benefits you offer will impact the employee’s paycheck.

3. Gather employee information

If you have employees, you should also have their W-4s, I-9s, and state withholdings. These documents will give you each employee’s personal information, Social Security number, and tax filing status. If your payroll includes things like employee health insurance or retirement savings, you’ll need documentation showing the employee has approved additional deductions. Lastly, if you plan to offer direct deposit, now is the time to get employee consent and collect their banking information.

4. Set up direct deposit

Direct deposit isn’t free, but it’s convenient for both employees and their employers, so it’s common. As a business owner, you can set up direct deposit through your business’s bank directly or your payroll service provider. If your employees have opted for direct deposit, they’ll have to give you some information. This includes their bank’s name, their account number, their account type (checking or savings), and their bank’s routing number. Once you have all that, the next step is to transfer that information to your payroll software or bank.

5. Establish a time tracking system

The FLSA requires employers to maintain accurate records of work hours for all nonexempt employees. In most cases, “nonexempt” includes hourly employees. One way to maintain those records is to track hours manually and ask employees to write down when they clock in and out. Otherwise, you might try a time tracking software that holds on to employee timesheet records for you. Either way, you’ll want to train employees to track their time as soon as possible.

6. Collect employee timesheets

Congratulations—you’ve reached the end of the pay period! It’s time to run your first payroll, which means it’s time to collect employee time cards. If they’re paper time cards, you’ll need to spend some time adding up the hours, checking for any mistakes, and transcribing the numbers to your payroll records. If the time cards are digital, now is the time to import them to your payroll software. Depending on the product, those timesheets may already be sitting inside your payroll software, waiting for approval.

7. Approve and submit employee payroll

Approval is the most important step when running payroll for hourly employees. This is your chance to make sure all the hours worked make sense, so payroll is accurate. Once you have approved all employee time cards, you’re ready to run payroll and issue payments to employees.

8. Report and update payroll records

Once the checks are out the door, it’s time to update your payroll records. Those records must show you’ve withheld federal income, Social Security, and Medicare taxes from employee wages. You also have to show the tax contributions you’ve made.

Payroll records are important for other reasons too. For instance, the Age Discrimination in Employment Act (ADEA) requires employers to keep all payroll records for three years. That information must include any employee benefit plans (including retirement or insurance) and any written seniority or merit system in place.

How long does it take to process payroll?

Processing payroll may take several hours, depending on your number of employees and the tools you use. The more manual the process, the longer it will take.

Automated payroll and time tracking tools can reduce that time considerably. One reason is that most payroll processing solutions calculate payroll taxes for you, which could take hours if done by hand.

Once you submit payroll, the time it takes for those checks to hit your account depends on the type of deposit. Some payroll providers offer same-day direct deposit or next-day direct deposit. In general, though, it takes about two to three days.

Danielle Higley is a copywriter for TSheets by QuickBooks, a time tracking and scheduling solution. She’s been a contributor to MSN.com, FiveThirtyEight, and a variety of HR and business blogs where she can put her affinity for long-form storytelling to best use. Read more