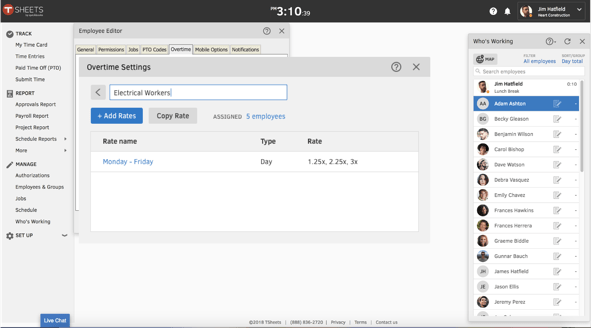

The Pay Rate Engine can handle complex calculations for you

We get it, calculating overtime can be a huge, complicated hassle — and it can take up hours of your precious time. Whether your state mandates complex overtime laws or your industry demands it, the QuickBooks Time Pay Rate Engine can handle even your most advanced calculations.

Advanced overtime settings include:

- Multiple pay rates by hours of the day

- Overtime rates by week or pay period

- Different pay rates on different days of the week

- Preset holiday rates