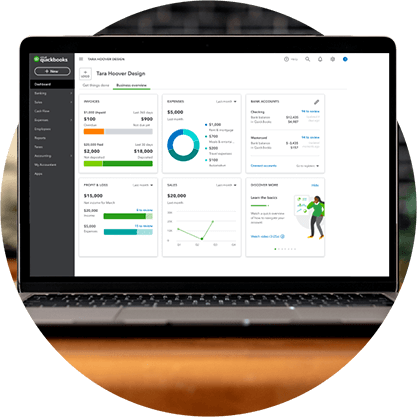

Why QuickBooks Online?

Small businesses in the UAE and around the world already rely on QuickBooks to help them track and report Value Added Tax (VAT). With QuickBooks’ one-click VAT reports, small businesses save hours each month.

Track VAT in seconds

Automatically track and calculate VAT in seconds with QuickBooks Online. QuickBooks is pre-filled with the UAE VAT rate of 5%. You can also easily add and edit your own tax rates to suit your business. When you’re ready to submit your VAT claim, QuickBooks prepares an accurate activity statement to help you with your filing. Every time you create an invoice or expense, QuickBooks will automatically calculate the VAT for you.

No more data entry

It's time to swap manual data entry for automatic and accurate calculations and record-keeping. Take photos of your business receipts and attach them to transactions. QuickBooks saves your transactions in one convenient location, so you’re always prepared for your VAT claims. Log in to your account anytime, anywhere using your smartphone, tablet, or computer.