Reviews that speak volumes

Discover what makes QuickBooks Online the #1 accounting software for small businesses.1

★★★★★

I work at a doctors office and use quickbooks to manage all of the bills that are paid for the practice. It is easy to learn and user friendly.

It can easily keep an eye on all the payments and bills as it provides me all the information of [a] customer's transaction.

Bills don’t belong in a spreadsheet

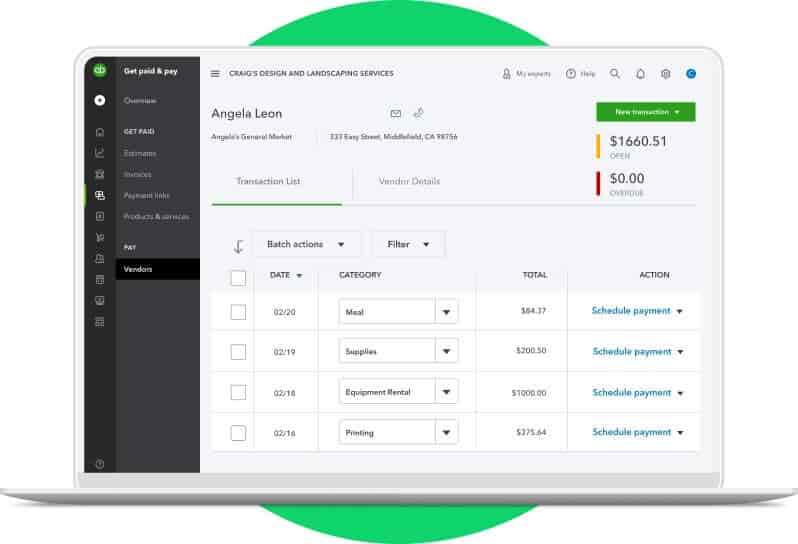

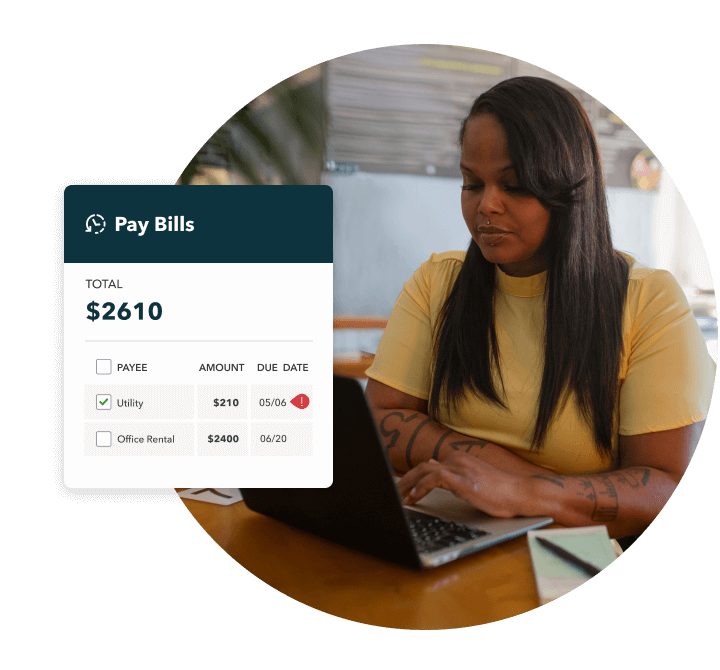

Keep up with due dates for everyone you owe. The bills dashboard shows you what you owe, when, and to who, in a glance.

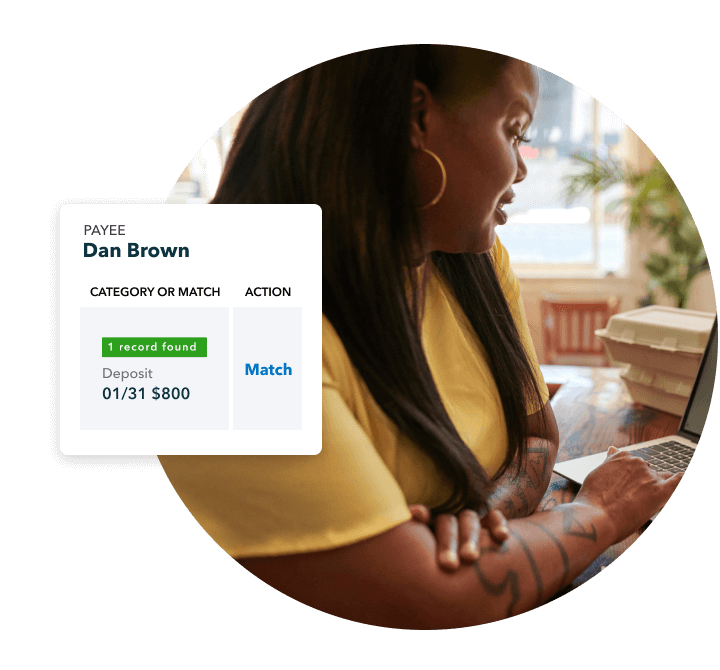

Once you connect your bank or business accounts (like Apple Pay® or PayPal), we’ll import your bill payments and match them to your vendors’ invoices.**

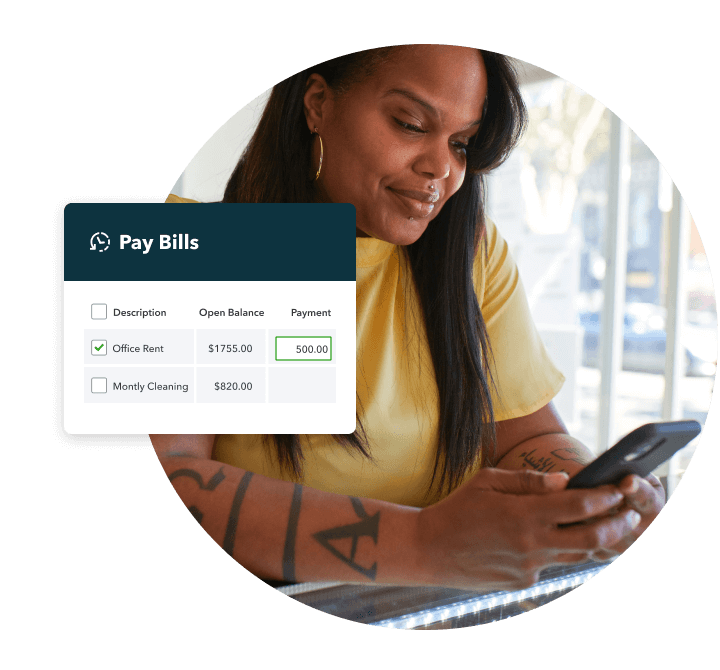

Enter the amount you want to pay and QuickBooks automatically tracks anything you still owe and when it’s due.

Go from bill pain to bills paid

QuickBooks makes it simple to control your cash flow, so you pay when it’s right for you.

Bill pay powered by Melio**

Pay bills online, contact-free

Pay bills for free via bank transfer, or pay via debit card (2.9% fee). Pay multiple vendors at once, with either direct deposit or paper check ($1.50 fee per check).

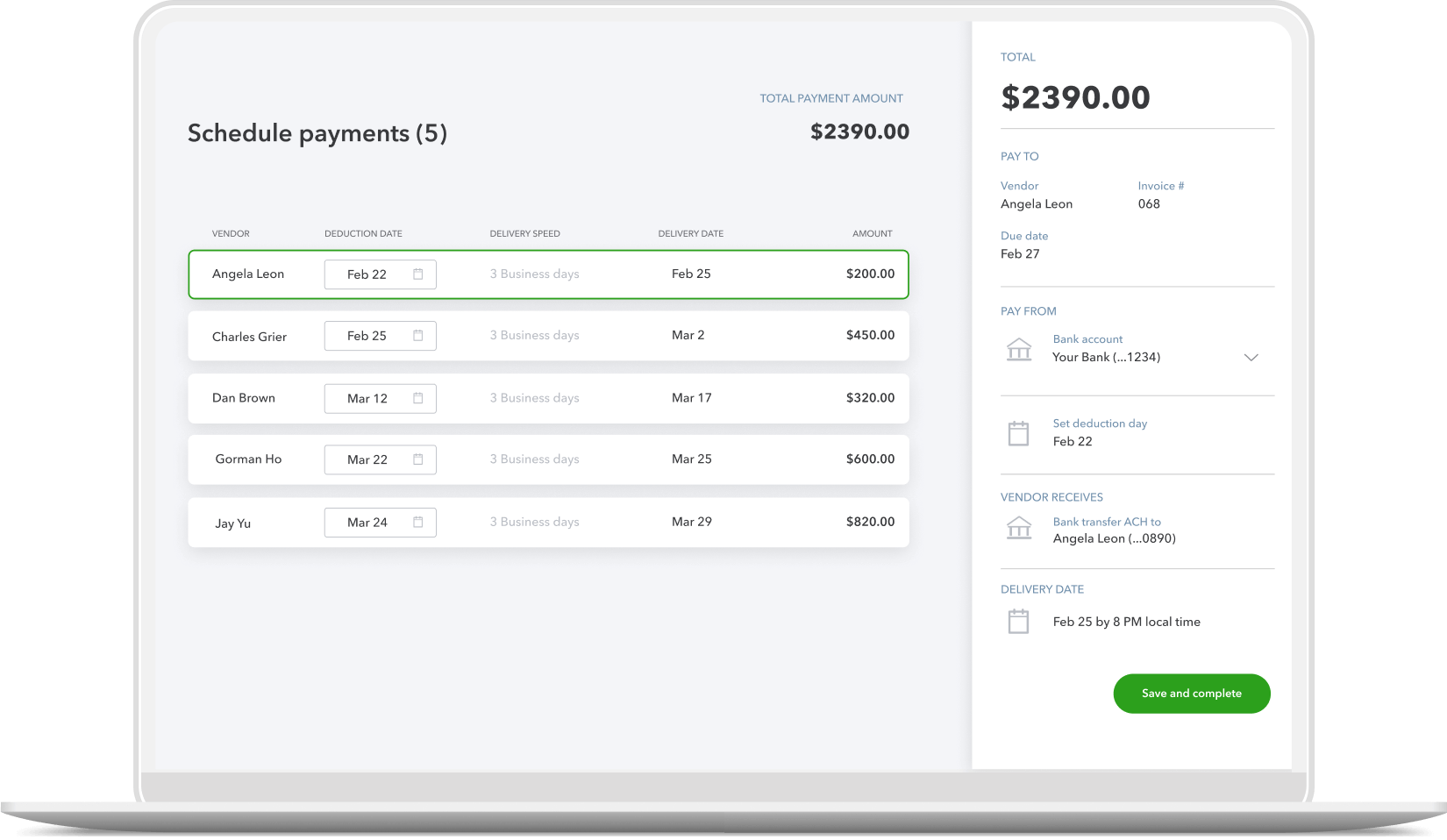

Schedule future payments

Don’t want to pay today? Schedule payments in advance for an easier, faster way to manage your expenses.

Defer bills to keep your cash longer

Pay bills with a credit card (2.9% fee) to earn rewards and buy more time before money-in becomes money-out.

Automate your bill entry

Upload or import invoices from your vendors to autofill bills and reduce manual entry.

Find a plan that’s right for you

Free Guided Setup

- Connecting your banks and credit cards

- Automating the tasks you perform most

- Learning best practices to use QuickBooks with confidence

Not included with QuickBooks Self-Employed**

Frequently asked questions

More ways to learn about managing business bills

Find more of what you need with these tools, resources, and solutions.