- ProductsProducts

- By solutionBy solution

- AccountingTrack income, send invoices, and more.

- Accounting with live bookkeepingOrganize books with a live bookkeeper.

- Advanced accountingScale smarter with profitability insights.

- PaymentsAccept all types of payments.

- PayrollRun payroll with ease.

- Time trackingTrack time and projects on the go.

- Combine QuickBooks solutions

- By business

- Plans & Pricing

- Why QuickBooksWhy QuickBooks

- How QuickBooks worksHow QuickBooks works

- OverviewExplore features that help your business, no matter your size.

- Invoicing

- Run payroll

- Manage cash flow

- Track expenses

- Manage bills

- Manage e-commerceGrow your product-based business with an all-in-one-platform.

- See all

- What’s newOur latest innovations that help you work faster, smarter, and better.

- Test driveTake our product for a spin, no strings attached.

- Compare to other softwareSee how we compare with other financial solutions.

- For your business typeFor your business type

- Support

- Talk to Sales: 1.877.683.3280Talk to Sales: 1.877.683.3280

- Sign in

Calculate sales tax

We keep track of thousands of tax laws so you don’t have to.

Sales tax calculations made easy

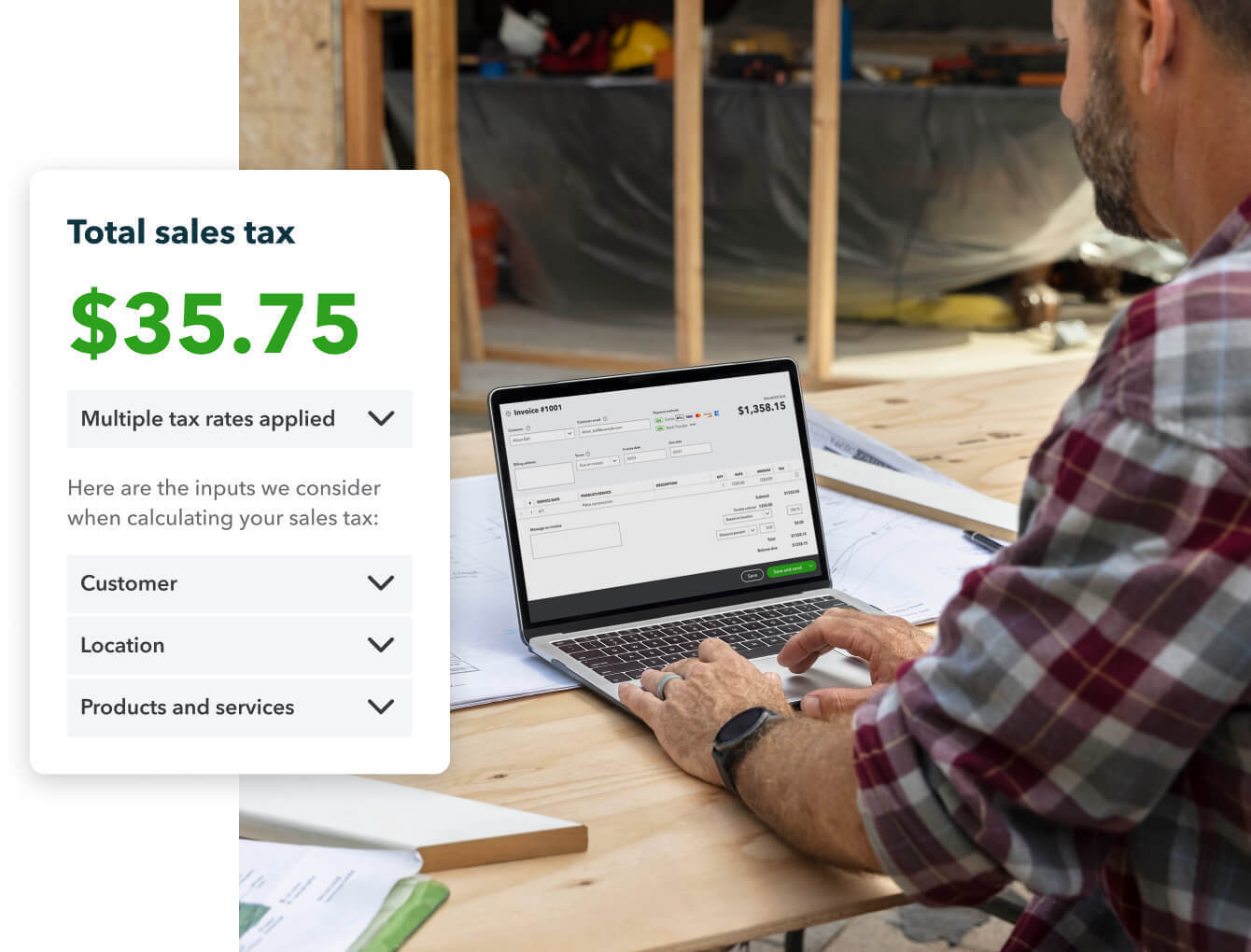

Automatic sales tax calculation

When you add sales tax to an invoice in QuickBooks, the calculations are automatically taken care of. We calculate the sales tax rate based on date, location, type of product or service, and customer you indicate.

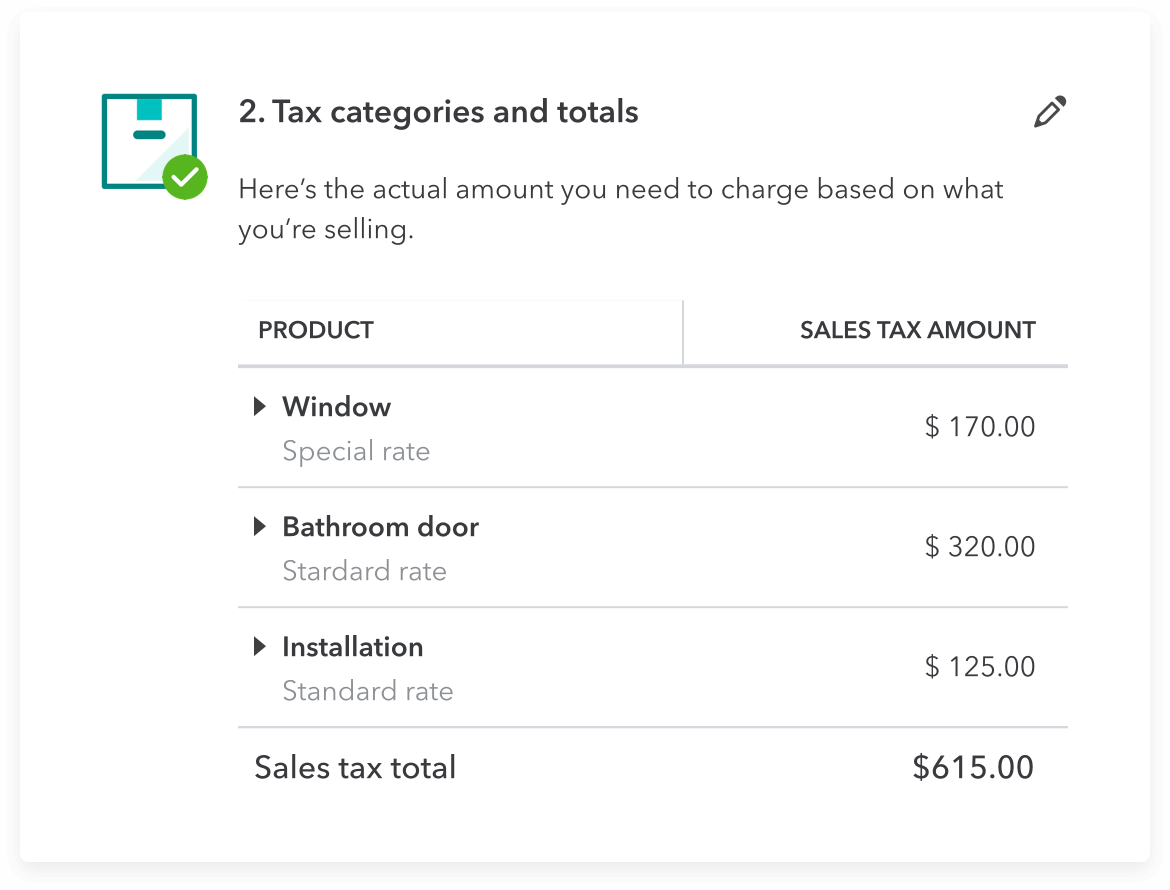

Product categorization

Rules for how to tax a product can change from state to state. Once your products are categorized, QuickBooks will make sure the correct rate is applied to your transactions based on the product category and the location of sale you indicate.

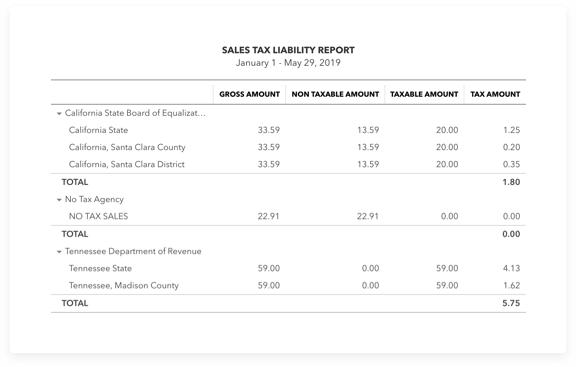

Know how much you owe

You can view your sales tax information any time with the Sales Tax Liability Report. This on-demand report will keep you up-to-date on your taxable and nontaxable sales, all broken down by tax agency.

Flexible QuickBooks Online plans for your business

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Offer terms*

QuickBooks Discounts: Discount applied to the monthly price for QuickBooks Online (“QBO”) and/or QuickBooks Online Payroll Core, Premium, or Elite (“Payroll”) is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. Your account will automatically be charged on a [monthly/annual] basis until you cancel. Each employee is an additional $6/month for Core, $8/month for Premium, and $10/month for Elite. Contractor payments via direct deposit are $6/month for Core, $8/month for Premium, and $10/month for Elite. Service optimized for up to 50 employees or contractors and capped at 150. The service includes 1 state filing. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. There is no additional charge for additional state tax filings in Elite. The discounts do not apply to additional employees and state tax filing fees. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO and/or Payroll customer and sign up for the monthly plan using the “Buy Now” option. This offer can’t be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your QBO cancellation will become effective at the end of the monthly billing period. The Payroll subscription will terminate immediately upon cancellation.You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Cancellation policy: There’s no contract or commitment. You’re free to switch plans or cancel any time.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Features**

Batch invoices: QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time.

QuickBooks Online Advanced – Priority Circle: Membership in Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging Premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

HR services: HR support is provided by experts at Mineral, Inc. See Mineral’s privacy policy and Terms of Use. The HR Support Center is available only to QuickBooks Online Premium and Elite subscriptions. HR Advisor support only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

Product information**

Availability: QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks plan.

Mobile apps: The QuickBooks Online mobile and QuickBooks Self-Employed mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Usage limits: QuickBooks Online Advanced includes unlimited Chart of Account entry. Simple Start, Essentials and Plus allow up to 250 accounts. QuickBooks Online Advanced includes unlimited Tracked Classes and Locations. QuickBooks Plus includes up to 40 combined tracked classes and tracked locations. Tracked Classes and Locations are not available in Simple Start and Essentials.

Claims#

1. QuickBooks Online Advanced – Batch Invoicing and Create Invoices 37% Faster claim: Based off of tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow. QuickBooks Online Advanced supports the upload of 1,000 transaction lines for invoices at one time. Number of invoices imported depends on the number of transaction lines in the .CSV file. Customers received remuneration for participating in the tests.

2. Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. Learn more about Tax Penalty Protection.

3. Over 98% of customers recommended QuickBooks claim: Based on a survey of small businesses using QuickBooks in the U.S. conducted September 2018.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Add sales tax to invoices

Easily add sales tax to invoices. You can include sales tax on your invoice templates, or you can add sales tax to individual invoices. When you add sales tax to an invoice, the calculations and tracking are done automatically for you.

Automatic sales tax tracking

Sales tax is a fee charged by government agencies, and in order to collect it, your customers pay the tax to you and then you are required to pass it on by making tax payments. Because QuickBooks automatically records your transactions, it keeps track of how much sales tax you need to send to the tax agencies.

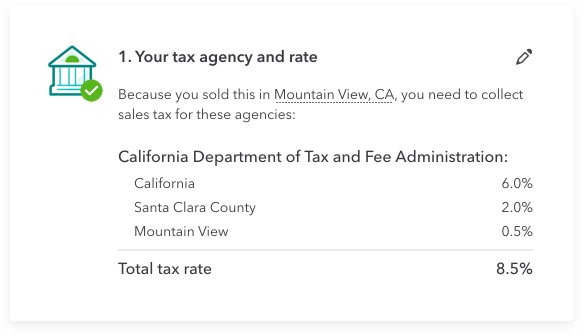

Collect sales tax for multiple tax agencies

You may need to pay sales tax to multiple tax agencies, such as your city, your county, and your state. In QuickBooks, you can use a combined rate to charge your customer one sales tax amount, and then QuickBooks will split out the appropriate amounts for each tax agency.

Easily accessible reports

The Sales Tax Liability Report (STLR) shows a summary of sales tax you’ve collected and owe to the tax agencies. It gives you the total taxable sales, total nontaxable sales, tax rate, tax collected, and sales tax payable – all broken down by tax agency.

Frequently asked questions

Sales tax is a tax that is paid to a tax authority for the sale of goods and services. Sales taxes can also be referred to as retail, excise, or privilege taxes, depending on the state. Sales tax is paid by the buyer and is collected by the seller. The seller has the obligation to remit the tax to the proper tax agency within a prescribed period.

Sales tax provides a state or local government with funds for public services. Some examples include improving education, building and maintaining infrastructures (roads, parks, and government-owned buildings), and hiring firefighters or police officers.

The sales tax rate can change based on your location because each state in the US has the authority to impose a sales tax. There is no federal law that tells states the rate to charge. Each state and local government can set the rate at a percentage within their state guidelines. For example, the rate on a sale in Massachusetts is 6.25% across the state, but if you shop in Texas, the rate can range from 6.25% to 8.25%

Sales tax is generally required in all states that impose it. As a buyer, if a seller fails to charge you a sales tax, you’re not required to pay the sales tax. As a seller, if you fail to collect and/or pay a sales tax, and the tax authority determines it’s due, the authority will assess penalties and interest. They can ultimately take assets or put liens on them, which can have negative effects on your credit.

Use tax is a tax on goods or services purchased outside of a buyer’s home state and/or that they didn’t pay sales tax on. The buyer pays this tax to the tax authority, usually on a state income tax return. Sales tax and use tax rates are generally the same. They are based on the location where the item was consumed or “used.”

There are 45 states and the District of Columbia that require businesses to collect sales tax. If you sell goods (and certain services) in one of these states you are responsible for calculating, collecting, and paying sales tax. Each state has its own set of laws and rates for sales tax. On top of state requirements, counties, cities, and districts may have their own sales tax requirements.

When it comes to sales tax, there are several types of nexus, but the most common are:

Physical nexus – To have a physical nexus with a state is to have a sufficient physical presence in that state. The physical nexus obligation exists in all states. Physical nexus can be created by:

- An office

- An employee or sales people

- Providing services

- An independent contractor that provides services to your customers

- A warehouse

Economic nexus – To have economic nexus in a state is to have made a certain amount of sales or a certain number of transactions into that state. Economic nexus obligations already exist in multiple states with additional states enacting economic nexus rules in light of the 2018 Supreme Court decision in South Dakota v. Wayfair.

Bottom line is that if you have nexus in a state (physical or economic nexus) you have an obligation to collect and remit sales tax for taxable sales within the state

In the past, online sellers typically would not need to collect sales tax for out of state sales if they did not have a physical presence in the state. Recent tax laws have changed this and now sellers are responsible for collecting sales tax on shipped items if they have an economic nexus with a state. Online sales tax varies from state to state and is dependent upon if you have nexus with that state.

Keeping track of sales tax can get messy, but we’ve got your back. QuickBooks sales tax automatically applies applicable sales tax rates to your invoices. We take into account all the variables and apply the correct rates every time.

Join over 7 million customers globally and find the QuickBooks plan that works for you.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Offer terms*

QuickBooks Discounts: Discount applied to the monthly price for QuickBooks Online (“QBO”) and/or QuickBooks Online Payroll Core, Premium, or Elite (“Payroll”) is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. Your account will automatically be charged on a [monthly/annual] basis until you cancel. Each employee is an additional $6/month for Core, $8/month for Premium, and $10/month for Elite. Contractor payments via direct deposit are $6/month for Core, $8/month for Premium, and $10/month for Elite. Service optimized for up to 50 employees or contractors and capped at 150. The service includes 1 state filing. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. There is no additional charge for additional state tax filings in Elite. The discounts do not apply to additional employees and state tax filing fees. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QBO and/or Payroll customer and sign up for the monthly plan using the “Buy Now” option. This offer can’t be combined with any other QuickBooks offers. Offer available for a limited time only. To cancel your subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your QBO cancellation will become effective at the end of the monthly billing period. The Payroll subscription will terminate immediately upon cancellation.You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Cancellation policy: There’s no contract or commitment. You’re free to switch plans or cancel any time.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Features**

Batch invoices: QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time.

QuickBooks Online Advanced – Priority Circle: Membership in Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging Premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

HR services: HR support is provided by experts at Mineral, Inc. See Mineral’s privacy policy and Terms of Use. The HR Support Center is available only to QuickBooks Online Premium and Elite subscriptions. HR Advisor support only available in QuickBooks Online Payroll Elite. HR support is not available to accountants who are calling on behalf of their clients.

Product information**

Availability: QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks plan.

Mobile apps: The QuickBooks Online mobile and QuickBooks Self-Employed mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Usage limits: QuickBooks Online Advanced includes unlimited Chart of Account entry. Simple Start, Essentials and Plus allow up to 250 accounts. QuickBooks Online Advanced includes unlimited Tracked Classes and Locations. QuickBooks Plus includes up to 40 combined tracked classes and tracked locations. Tracked Classes and Locations are not available in Simple Start and Essentials.

Claims#

1. QuickBooks Online Advanced – Batch Invoicing and Create Invoices 37% Faster claim: Based off of tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow. QuickBooks Online Advanced supports the upload of 1,000 transaction lines for invoices at one time. Number of invoices imported depends on the number of transaction lines in the .CSV file. Customers received remuneration for participating in the tests.

2. Tax penalty protection: Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. Learn more about Tax Penalty Protection.

3. Over 98% of customers recommended QuickBooks claim: Based on a survey of small businesses using QuickBooks in the U.S. conducted September 2018.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Products

Features

Call Sales: 1-877-683-3280

© 2023 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Mint, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions.