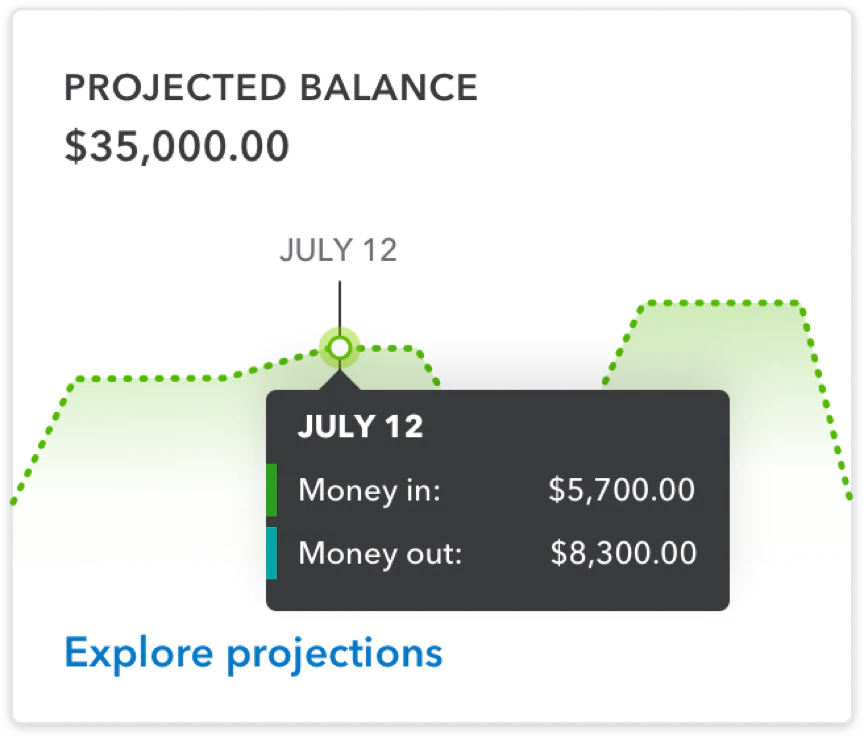

Forecast money-in and money-out up to 90 days to plan ahead, and stay ahead.**

Custom cash flow planning

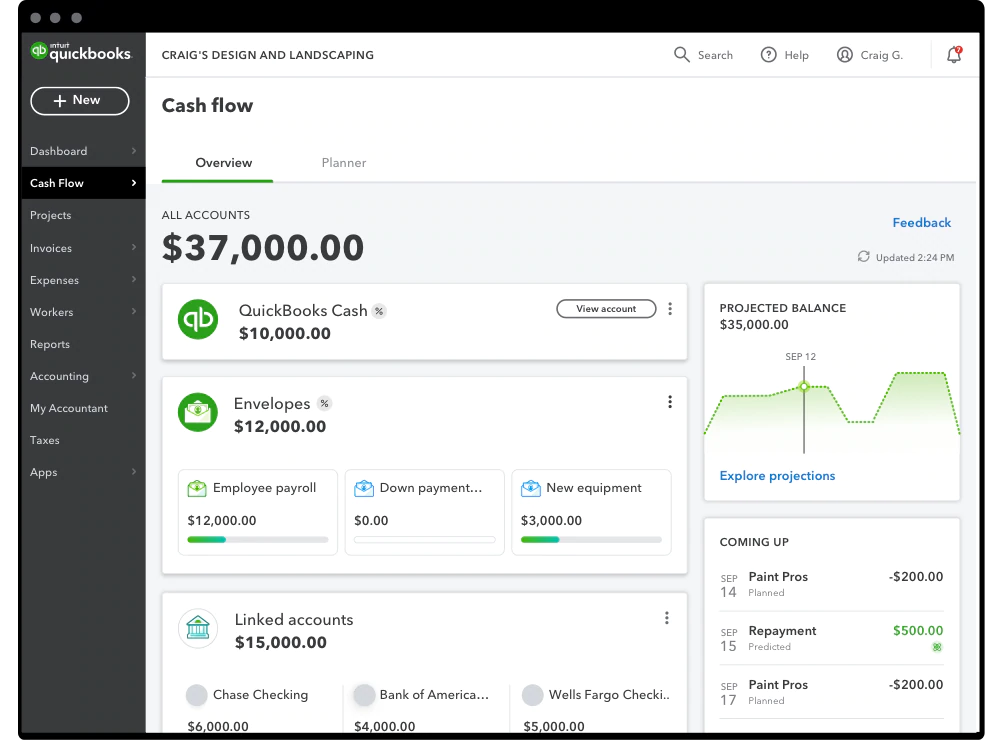

All your accounts at a glance

No messy spreadsheets. See all your business balances on one dashboard.

QuickBooks Checking account

Manage your money in QuickBooks, featuring instant deposit at no extra cost, if eligible and no monthly fees or account minimums.**

See the future of your cash flow

The Cash Flow Planner uses your bank and QuickBooks activity to forecast money-in and money-out 30 and 90 days ahead. Know where business is going so you can budget wisely.**

Get all-in-one financial clarity

Start each day with a full financial picture. No matter the account, every transaction syncs right to your dashboard so you can monitor all your business balances, all in one place.

Grow and access funds fast with QuickBooks Checking

QuickBooks Checking is a business bank account built in QuickBooks, with perks made just for small businesses:

- Instant deposit, no extra cost. QuickBooks Payments deposit instantly for no added fee, if eligible. Spend right away using your QuickBooks Debit Card.**

- Envelopes for easy budgeting. Bucket cash in virtual envelopes to save for things like goals, expenses, and emergencies.**

- Money that works 40x harder. Use envelopes to earn interest at 1.75% APY (over 40x the U.S. average1) on envelope balances.**

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

Since we started using the QuickBooks Cash Flow Planner, we no longer rely on tracking this manually in a spreadsheet. It saved us a lot of time and frustration and gives me the knowledge that I need to make decisions.

I used insights from the QuickBooks Cash Flow Planner to decide I was able to hire my first employee. I assessed my cash flow, and the Cash Flow Planner confirmed that I’d be able to support an employee.

Start managing your cash flow in QuickBooks

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

What is cash flow? An in-depth guide for business owners

By Kathryn Pomroy July 10, 2020

Cash flow is the movement of money in and out of your business and your business bank account.

Think of cash flow like your car’s gas tank. You fill up the tank with gas, and it empties as you drive. The goal, however, is to have enough gas in your tank so that you never run on empty.

In the same way, cash flow is the movement of cash in and out of your business account. Cash inflows are your sources of income. Cash outflows are your business expenses. Naturally, positive cash flow is better than negative cash flow.

Why being cash flow positive is important to your business

Positive cash flow should be the goal for all small business owners. You want to generate more money than you’re spending. That sounds simple, but plenty of profitable businesses run into cash flow problems. It can be challenging to balance regular business expenses—salaries, rent, technology updates, etc.—with things less under your control. Think sporadic revenue and periods of negative cash flow from seasonal patterns or investments in growth. To achieve and maintain positive cash flow, you should understand where your cash goes and how to get more when you need it.

4 tips for cash flow management

There are a number of tips for managing cash flow for your small business. Here are four to consider.

Practice calculating it yourself: Calculating cash flow is fairly simple if you know your operating expenses and your revenue. First, identify the period you want to calculate. Subtract the business’s operating expenses for that period from the business’s revenue of the same period.

Maintain some cash reserves: As a business owner, it’s not your job to anticipate every speed bump on your journey. But it does help to have a rainy-day fund to pay for any damage you take as a result. Having enough savings to help cover a month or two of expenses will help ensure you never fall behind when business is slow.

Focus on cash flow management, not profits: If your business invoices customers, you know what it means to wait (and wait) to get paid. Consider offering discounts to customers who pay early, and charging a late fee for those who miss their deadline. You might also adjust your contract with customers, so invoice due dates are more air-tight. Otherwise, you might invest in an invoicing software that can remind customers to pay on your behalf.

Operating activities: You’ll soon learn it’s possible to be profitable while still experiencing slow or negative cash flow. For instance, say you’ve sent out 10 invoices for $100 each, based on work you did amounting to $50 per job. You’ve made a profit of $500. Alas, until your customers pay those invoices, you’re in the hole (cash flow negative) by $500—the amount you invested in those jobs. That’s why it’s important to put more stock into your cash flow than your profits. Focusing on profits might give you an inaccurate picture of how your business is performing.

Types of cash flow

There are a few different kinds of cash flow, depending on who you ask. Some might list operating cash flow, financing cash flow, and investing cash flow. Others might list past cash flow, future cash flow, and net cash flow. Either way, cash flow “types” are metrics. There are two common types of cash flow metrics: operating and free.

What is operating cash flow?

Operating cash flow measures cash that’s generated by the company’s business operations. Business owners like it as a metric. It can tell them if they have enough funds coming in to pay the business’s bills or operating expenses. Investors will also be interested in your business’s operating cash flow. It can help them determine if your business is financially viable long-term.

What is free cash flow?

Free cash flow measures the cash a company generates from business operations after they subtract capital expenditures.

You may have heard the terms “levered free cash flow” and “unlevered free cash flow”. To understand the difference, it may help to imagine a cake.

Unlevered cash flow is the cake when it’s whole. It’s all the money the business has before it’s paid off any financial obligations.

But then, the business pays off some debts, operating expenses, interest payments, etc. Each one takes a slice out of the cake.

Levered free cash flow is what’s left over. It’s the amount of money a business has after meeting its financial obligations.

What is a cash flow statement?

A cash flow statement tracks money in and money out of your company. It shows how much cash your company has on hand and provides insight into your company’s liquidity. It’s also known as a statement of cash flows. Publicly traded companies are required to release cash flow statements each quarter. You can create a cash flow statement on your own, or you can download a free cash flow statement template from QuickBooks.

Income statement versus cash flow statement

Cash flow statements, along with balance sheets and income statements, help provide insights into a company’s finances. But business owners aren’t always sure how they connect.

The balance sheet gives you an overall view of your company’s finances. It’s split into assets, liabilities, and equity. The cash balance from the company’s cash flow statement appears on the balance sheet in the asset section.

The income statement shows a company’s revenue, expenses, and profit and losses. It offers insights into a company’s profitability. The bottom line of your income statement is net income. You can use your net income to calculate cash flow from operating your business. Any non-cash income from the income statement, such as depreciation and non-cash expenses, flows into the cash flow statement and affects net income.

Each accounting statement can help you understand your company’s performance from all angles. The balance sheet and cash flow statement focus on the financial management of your company in terms of its structure and assets. The income statement shows you which core operating activities generate the most income for your company.

Cash inflow versus cash outflow

Poor cash flow management is among the leading reasons businesses fail, according to a 2019 study from CB Insights. Understanding the cash inflows and outflows on your cash flow statement is critical if you want to keep your business up and running.

Cash inflow is the money going into your company. It may be from investments and financing or sales. Cash inflow is the opposite of cash outflow, which is money leaving your business for things like payments to vendors and disbursements. For your company to be healthy financially, your cash inflow must be greater than your cash outflow.

On your cash flow statement, you will find operating activity, investing activity, and financing activity, in that order. Add the total cash gained from or used by each of the three activities to see the change in cash for the period. Then add that to the opening cash balance to reach your cash flow statement’s bottom line, also known as the closing cash balance.

Revenue versus cash flow

Revenue is the total income generated by sales related to your company’s primary operations. In other words, it’s always cash inflow. On the other hand, cash flow is the total amount of money moving in and out of a business at a given time.

Then there’s profit. Profit is the amount of money left over after a business pays and subtracts all expenses. And contrary to what you might think, it’s possible to be profitable but still have negative cash flow.

You can see this most clearly when you compare an income statement to a cash flow statement in accounting. The most significant difference between the two is that the income statement may be based on accrual accounting. The cash flow statement is based on cash basis accounting.

It’s critical to know how accrual accounting and cash basis accounting work, so you can choose the best reporting method for your business. It’s also important to know that as long as your sales are less than $25 million per year, you can use either.

Cash basis accounting versus accrual accounting

Cash basis accounting identifies revenue when it’s received and expenses when they’re paid. It does not recognize accounts receivable or accounts payable. Many small businesses use cash basis accounting because it’s simpler to maintain. You can look at your bank balance to see a transaction or how much cash your business has at any given time.

Accrual accounting records revenues and expenses when they are earned, irrespective of when the money is received or paid out.

For example, if you paid $240 upfront for a two-year newspaper subscription, your cash flow statement would show a cash outflow of $240 immediately. On the other hand, your income statement would break down the $240 into each accounting period, usually monthly or quarterly.

Think of it this way: Let’s say you started a company. After one year, you ran into cash flow issues, even though your business was profitable. As a small business, you relied on invoices to collect accounts receivable from customers. As anyone who sends invoices knows, customers don’t always pay on time. Even though your company was profitable, according to your income statement, you were short on cash.

You may have had the best intentions but failed to make payment deadlines because you couldn’t manage your company’s cash outflow and inflow. The relationship between cash flow and profit will vary, depending on the type of business. You can be profitable but have times of slow or inconsistent cash flow.

How to read a cash flow statement

A cash flow statement adds operating activities, investing activities, and financing activities to determine available cash. The formula follows:

Operating activities + investing activities + financing activities = available cash

Following the equation should show you the changes in cash balances from one period to the next. That way, you can always stay on top of your company’s cash flow.

Operating activities

Also called operating cash flow, operating costs show how much you’ve spent or made each day. It’s the amount of money your company brings in from any ongoing, regular business activities, such as selling products, manufacturing, or providing services. It is the most accurate assessment of how much money you’ve generated from your core business.

Investment activities

Also called cash flow from investing activities, asset investments show cash used to buy or sell long-term capital assets for your business. These assets may be equipment, property, machinery, vehicles, furnishings, or investment securities. Over time, you want to see that your business can pay for these investments with income generated from its operations.

Financing activities

Financing is cash received from or paid to lenders, other creditors, and investors if you have them. This is where publicly traded companies report cash flow from the sale of stocks and bonds, payment of dividends, or repayment of debt capital.

What causes cash flow problems?

Cash flow problems occur when business owners don’t understand the difference between profits (sales) and cash flow. It’s easy to think that the key to positive cash flow is increased sales, but that’s not always the case. More often than not, cash flow is a challenge because income is sporadic while expenses are recurring. It may be possible to fix the problem with more or bigger sales. But if those efforts aren’t sustainable, cash flow problems will resurface.

Here’s an example: Say you own a business that sells hot tubs. Sales are good—up year over year. You have several orders from customers, which means half the tubs in your store are reserved. You know that inventory will be paid for soon, and you don’t want empty space in your store. You anticipate a need for more inventory, so you purchase it. Unfortunately, until your customers pay for their reserved hot tubs, all your money is now tied up in inventory and accounts receivable. You might be having a great month sales-wise, but that doesn’t mean you have enough cash to pay your bills.

Controlling your accounts receivable is one of the best ways to increase cash flow. And there are plenty of ways to get paid faster. Even so, it’s not always easy. The best way to stop mounting past-due receivables is not to let them pile up in the first place. If a customer wants to reserve a hot tub, make them pay for it upfront.

More than that, though, avoiding cash flow problems often comes down to awareness and making small changes before small problems build up. So it helps to perform a cash flow analysis, regardless of how great sales are looking.

Performing a cash flow analysis

The first step to performing a cash flow analysis is to make a cash flow statement. We now know a cash flow statement is created by adding up your business’s operating activities, investing activities, and financing activities. To conduct your analysis, you may need to take a hard look at your budget or banking history.

The second step to performing a cash flow analysis is to familiarize yourself with your business’s finances. Here are four things to check on as you go through the numbers.

- Positive cash flow: As you look at business operations, there should be more money coming into your business (inflow) than going out (outflow).

- Billing and collections: Find out how long it takes the average customer to pay their invoice. If late payments are affecting your accounts receivable, consider making some changes to your collections process.

- Loan amounts: If you’ve already maxed out your line of credit, you may find it challenging to try new initiatives that could grow your business. Maybe you’re right where you need to be, loan-wise. Or maybe it’s time to consider refinancing for a higher credit limit.

- Savings: You should have some money tucked away, just in case.

Looking at your business from all angles, including savings and invoicing, may help you better understand its financial health.

Cash flow you can bank on

Typically, solving your company’s cash flow issues comes down to getting all of your accounting in order. As the business owner, it’s entirely within your power to solve many of your business’s cash flow problems. But that doesn’t mean you can’t ask for help.

For even more business insights, check out an automated accounting software like QuickBooks. Run cash flow reports as often as you’d like, and compare those to other reports that show profits and sales. Never be in the dark about your business’s financial wellbeing ever again.

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

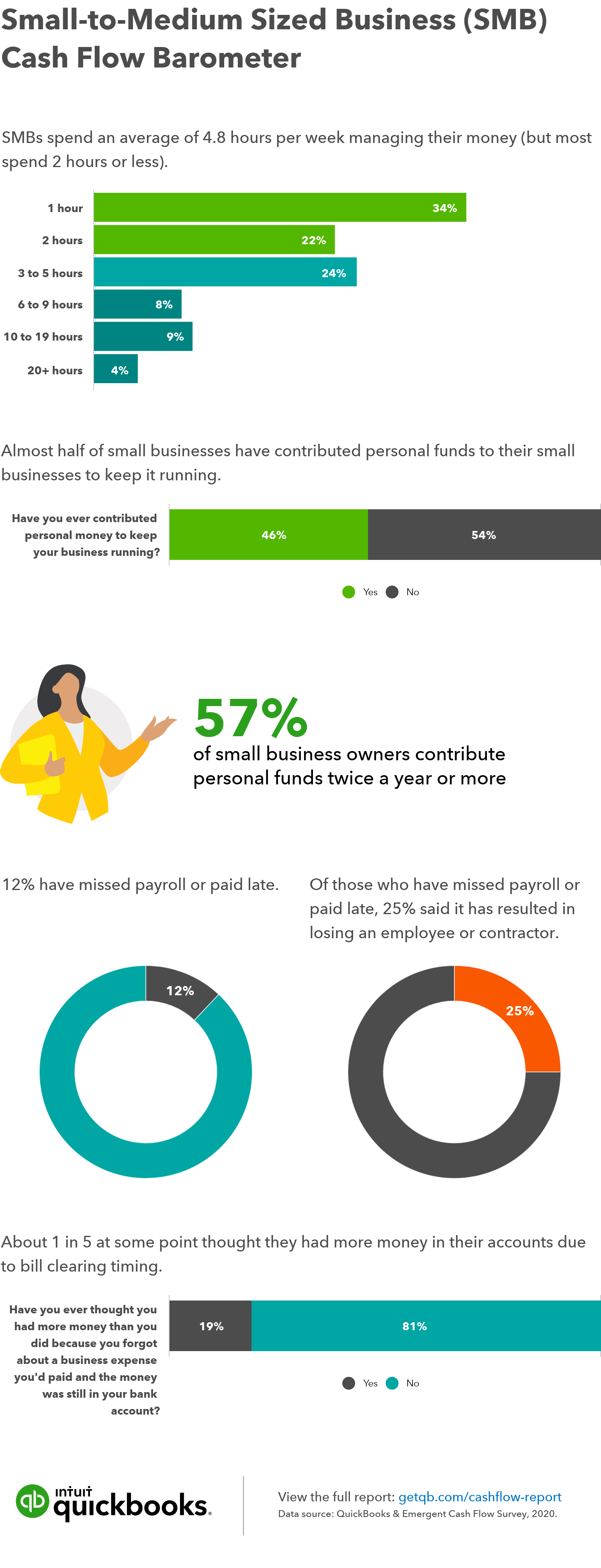

The state of cash flow for small businesses

By Danielle Ernst

Small business owners feel confident in their finances, but those who have experienced cash flow issues continue to struggle — their cash flow woes just don’t seem to go away, a new cash flow report from QuickBooks shows.

80%

of small business owners feel stressed because of their company’s cash flow

Similarly to the previous State of Small Business Cash Flow analysis, more than 3 in 5 small businesses (62%) polled for the global survey experienced a cash flow issue at some point during their company’s history. Many of these small business owners were not prepared for those challenges, and nearly half (44%) of small business owners who experienced cash flow issues say the problems were a surprise.

44%

of small business owners who had cash flow issues said the problems were a surprise

Despite these prior struggles, small business owners feel confident in their financial management skills. Most global small business owners (92%) say their cash flow is under control.

- 89% of small business owners say they know the amount of money their company has in monthly receivables.

- 92% feel they know how much money is coming into their business every month.

- 93% of small business owners know how much money their company spends on monthly business expenses.

They also have a positive outlook for the future of their business. Almost half (48%) of small businesses think their revenue will increase in the next year. This means a great opportunity for more hiring and more work.

Most global small businesses claim their cash flow is under control

While small business owners may feel confident, they also admit to experiencing recent struggles with cash flow. In fact, 59% of small business owners globally experienced cash flow issues in the past year, up from 42% in 2018, and many have trouble managing outstanding receivables and paying suppliers.

- In the United States, small business owners have an average of $78,355 in outstanding receivables, an increase of 81% ($43,394) compared to the 2018 report.

- 71% of global small business owners who have had cash flow issues struggled to pay their suppliers — and the same percentage say it had a negative impact on their relationship with the supplier.

- 64% of small business owners globally have been charged a fee for late payment specifically due to cash flow issues.

In 2019, U.S. small businesses had an average of 81% more in outstanding receivables

This disconnect between past experiences and future optimism shows that small businesses may be more confident than they should be, especially given their current economic outlook. Nearly 3 in 4 small business owners (71%) feel there will be an economic recession in the next two years.

Nearly 3 in 4 small business owners (71%) think there will be a recession in the next two years

Methodology

The QuickBooks Cash Flow Survey was conducted by Wakefield Research among 3,500 small business owners of companies with 0-100 employees, including 1,000 in the U.S. and 500 in the U.K., Australia, Canada, India, and Brazil, between Nov. 1-18, 2019, using an email invitation and an online survey. The margin of error is ±3.1 percentage points in the U.S. and ±4.4 percentage points elsewhere with a 95% confidence level. When reporting tracking data, quotas were set to ensure samples could be compared to data collected in 2018 in the U.S., U.K., Australia, Canada, and India. The Small-to-Medium Sized Business (SMB) Cash Flow Barometer includes data commissioned by QuickBooks from a survey of 1,004 U.S. adult small business owners and partner respondents from firms with 0-99 employees. The poll was conducted March 5, 2020, and the margin of error is +-3.1% at the 95% confidence level. The data were weighted using U.S. Census size data to reflect the small business sector of the U.S. economy.

State of payments for small business

By Alysha Love

The way money comes in — and how businesses accept and process payments — has a large effect on whether they’re cash-flow positive.

A big piece of the equation is how a business decides to get paid. 1 in 5 small businesses around the globe don’t accept credit cards, according to the 2020 QuickBooks State of Payments report. Choosing not to accept a common form of payment can put these businesses at a competitive disadvantage.

Why lose out on potential business? Of U.S. small business owners who don’t accept credit cards, nearly a third say it’s because the processing fees are too high. Even 9 in 10 business owners around the world who do accept credit cards agree that the fees are exorbitant.

Nearly all small business owners who offer credit card payments call the fees exorbitant

Getting paid is the first step. Understanding the cash in, cash out equation is next. It’s impossible for business owners to make accurate business projections without knowing exactly how much money they make and how much they owe. But 61% of small business owners worldwide don’t know exactly how much money they spend on a monthly basis.

61%

of small business owners don’t know exactly how much money their business spends each month.

Not knowing monthly expenses may feel like flying blind. What often exacerbates the problem: 62% of small business owners also don’t know exactly how much money lands in their bank accounts each month. That makes decisions about hiring, expansion, tax withholdings and expanded offerings a challenge to evaluate.

62%

of small business owners don’t know exactly how much money they receive each month

Nearly 1 in 5 business owners are in the dark on their cash flow because they’re not using a forecasting tool. But often, factors outside a business’s control create cashflow chaos.

Business owners were roughly split on whether the bigger cash flow pain point is not getting paid on time by customers (52%) or how long it takes to actually receive money after a payment is processed (48%).

Nearly two-thirds of small businesses wait more than 15 days on average to get paid, the worldwide survey found, and more than a quarter of small businesses say it takes more than 30 days. During this time, they still have expenses such as payroll, inventory, rent, and utilities, which can cause cash flow issues.

All those factors can lead to an outcome businesses hope to avoid: bad decisions.

58% say they’ve made a poor business decision because they were worried about cash flow

Small businesses have small margins for error, but 3 in 5 business owners said they’ve made a poor business decision because they were worried about cash flow.

Cash flow issues have caused 41% of small business owners globally to face the possibility that they couldn’t pay their taxes. Payment issues specifically have hurt small business owners’ relationships for 71% of those who’ve had problems with suppliers.

Read the full survey results

Methodology

The QuickBooks Cash Flow Payments Survey was conducted by Wakefield Research among 3,500 small business owners of companies with 0-100 employees, including 1,000 in the U.S. and 500 in the U.K., Australia, Canada, India, and Brazil, between Nov. 1-18, 2019, using an email invitation and an online survey. The margin of error is ±3.1 percentage points in the U.S. and ±4.4 percentage points elsewhere with a 95% confidence level. When reporting tracking data, quotas were set to ensure samples could be compared to data collected in 2018 in the U.S., U.K., Australia, Canada, and India.

The data provided above is for information purposes only. The survey participants are not QuickBooks customers and their responses are not intended for use in any marketing claims about QuickBooks products. Their responses do not represent the views of Intuit or its employees.

10 tips for using cash flow management to grow your business

By John Shieldsmith

December 9, 2019

Trying to run a business without managing cash flow is like trying to paddle a boat without an oar.

Even if you succeed, it will be an upstream exercise guaranteed to wear you out. Not to mention, poor cash flow management can result in your business shutting down completely.

With poor cash flow, it only takes one major downturn or disaster to leave you washed up.

To avoid this fate, let’s take a look at what exactly cash flow management is, and why it’s such an important part of financial management.

What is cash flow management?

Cash flow management is important for all businesses, but it’s critical for early startups. If you cannot manage your cash flow within the first year, you will likely not survive past the second year.

Poor cash flow can result in your business lacking the funds to pay suppliers or cover immediate needs.

A line of credit can only carry your business so far. Once your credit cards and loans are maxed out, you’re left needing cash or faced with the reality of shutting your doors.

Fortunately, you can perform a cash flow analysis to get an idea of whether you have positive cash flow or negative. Then you can take steps to move your business in the right direction.

To perform a cash flow analysis, you’ll need these three key elements:

Accounts receivable: What customers and clients owe you

Accounts payable: What you owe your suppliers

Shortfalls: When you owe more than what you have on a liability

You must effectively manage all three if you want to navigate your business to success. An imbalance in one area, like having clients that owe you too much or you owing suppliers too much, can throw your cash flow for a loop and ultimately hurt your business.

To actually determine your current cash flow, you’ll look at how much money you have coming in, and how much you have going out. If you have numerous customers or clients that owe you money but have yet to pay, make sure you’re not considering this as part of your cash flow.

Bad debt is exactly that, bad, and it isn’t helping the amount of cash you have on hand.

10 tips for determining and managing cash flow

Managing your cash flow is important, but if you don’t have any cash to manage in the first place, you’re in trouble. Fortunately, there are steps you can take to increase your cash flow and avoid potential cash flow problems.

Here are a few tips to help you row your cash flow boat in the right direction.

1. Determine your breakeven point

You should know when your business will become profitable, not because it will affect your cash flow — because it won’t — but because it gives you an early goal to strive for and a ready-made target for projecting future cash flow. Negative cash flow and negative profits make for a grim combination.

Focus your efforts on managing your cash flow with an eye toward reaching that moment when you realize your first profits.

To determine your breakeven point, you can either do a unit-based or dollars-based breakeven analysis. Both methods involve using your fixed costs, which are costs that don’t fluctuate. These include business needs like rent or utility bills.

To determine your breakeven point using units, start with your fixed costs. Then take your revenue per item sold and subtract the variable cost for each item. Now divide your fixed cost by that number.

When determining your breakeven point with the dollars approach you first need to calculate your contribution margin.

To find this, take the price of your service or product and subtract the variable cost. Then divide your fixed costs by the contribution margin.

2. Focus on cash flow management, not profits

This may sound contradictory to tip #1, but it’s not. Use your breakeven point as a benchmark. After you reach breakeven and your business is profitable, you still need to manage your cash flow, of course.

With your breakeven point reached, you at least know your business isn’t sinking. Now, you can look at those three categories from earlier — accounts receivable, accounts payable, and shortfalls — and see if any of them look like a potential problem.

If you’re breaking even but your free cash flow is already getting tight, it’s time to do a deep dive and look for issues.

Ask yourself if you could increase cash flow by requiring that new customers put more money down, or if you need to cut back on your current expenses and make some adjustments in-house.

Being new to the breakeven point is a great period of time for making these changes, as even the smallest changes can quickly reflect in your profit margin and give you an idea of what’s impacting your business cash flow the most.

When your business is more established and your numbers are higher, it can be more difficult to determine what’s impacting your financial health, as there are more players on the board and your finances are more complex.

3. Maintain some cash reserves

You will have cash shortfalls. Your business’s very survival may depend on how you maneuver through those shortfalls. If you start with some cash in your bank account, it will be easier to focus on cash flow and you won’t stress about the shortfalls.

As a best practice, try to have enough cash reserves to last you for a three-to-six month time period.

This amount of working capital can help you in the event of a temporary market downturn, allow you to shop for a new supplier if your current one raises their prices, and so on.

4. Use a cash flow worksheet

A cash flow worksheet will help you keep tabs on your general cash flow management. With a worksheet, you can track your cash outflows and cash inflows, and make general cash flow projections.

Here’s our free cash flow template for Excel. Fill out this worksheet regularly to make sure things are going smoothly and to ensure you don’t have any ugly surprises with cash flow in the coming months.

5. Collect receivables ASAP

It’s easy for customers to take their time on payments, especially if you have language like net-30 or “due in 30 days” on your invoice.

Instead, use a “due upon receipt” approach to show that payment is due in a timely manner.

If necessary, delegate the task of keeping an eye on receivables to a trusted and persistent member of your team. This person will contact customers periodically to collect payment and generally help you with collecting receivables.

6. Encourage customers to pay up faster

If it won’t hurt your bottom line too much, offer your customers early payment discounts. Also keep credit requirements strict to avoid bad debt. Establish a written set of standards for determining who is eligible for credit.

Enforce those standards rigidly. You don’t want every customer walking in the door approved for credit.

Financial institutions have very strict standards for credit, and your business should be no different.

7. Extend payables as long as possible

In contrast to receivables, get the best deal you can on payables. Extend your payables to net-60 or net-90 if you can. This will give you a higher cash balance but will also increase your debt. Some suppliers charge late fees, however, so make sure you pay on time to avoid being penalized.

This is another reason it’s important to have a healthy cash reserve on hand. If you owe suppliers and suddenly run out of money, you’re going to damage your supplier relationship and potentially lose your best supplier. They can also withhold your next shipment, which can interrupt your entire operation.

8. Boost sales with creative incentives

Think outside the box and come up with some fun ways to drive sales. Some creative ways to quickly boost sales might include sponsoring a contest, hosting a customer appreciation event, offering referral incentives, or taking your employees on a publicity tour.

These kinds of efforts can not only drive sales, but also boost your reputation and ultimately result in more customers.

9. Designate a cash flow monitor

Assign the task of monitoring cash flow to a trustworthy employee. Have that person inform you when you reach a certain threshold — for instance, when your cash flow hits $1,000.

This person should be knowledgeable in finances, especially your company finances. If you have an accountant with the bandwidth to handle this task, they would make an ideal choice. Otherwise, again, choose someone very trustworthy and reliable.

10. Use technology to your advantage

Keep cash flow spreadsheets in the cloud on sites such as Dropbox or OneDrive so you can access them from anywhere, and use professional accounting software.

Once you start using cloud-based technology, make sure you put some best practices in place to ensure security is always priority number one.

Smooth sailing with cash flow

As long as your cash flow stays positive, your business can survive turbulent waters. Project future cash flows based on history and sound financial data, always keep your income balances and sheets up to date, and stay vigilant.

Over time, cash flow management will become just another part of financial management for your company, and it will feel like second nature.

In no time at all you’ll be sailing upstream with ease, knowing your cash flow is in check and you’ve got a pair of backup oars onboard, ready to go. Now sail forth and manage that cash like the captain you are.

.png)