QUICKBOOKS PAYMENTS AND QUICKBOOKS CHECKING

- ProductsProducts

- By solutionBy solution

- AccountingTrack income, send invoices, and more.

- Accounting with live bookkeepingOrganize books with a live bookkeeper.

- Advanced accountingScale smarter with profitability insights.

- PaymentsAccept all types of payments.

- PayrollRun payroll with ease.

- Time trackingTrack time and projects on the go.

- Combine QuickBooks solutions

- By business

- Plans & Pricing

- Why QuickBooksWhy QuickBooks

- How QuickBooks worksHow QuickBooks works

- OverviewExplore features that help your business, no matter your size.

- Invoicing

- Run payroll

- Manage cash flow

- Track expenses

- Manage bills

- Manage e-commerceGrow your product-based business with an all-in-one-platform.

- See all

- What’s newOur latest innovations that help you work faster, smarter, and better.

- Test driveTake our product for a spin, no strings attached.

- Compare to other softwareSee how we compare with other financial solutions.

- For your business typeFor your business type

- Support

- Sign in

For existing QuickBooks Online customers

Sign up for a Payments account, or a Payments and QuickBooks Checking bundle.

Have QuickBooks Desktop? See payments for QuickBooks Desktop

For new QuickBooks customers

You’ll need a QuickBooks Online account to get QuickBooks Payments and Checking.

Offer terms

QuickBooks Products: Offer available for QuickBooks Online and/or QuickBooks Online Payroll Core, Premium, or Elite (collectively, the “QuickBooks Products”). The offer includes either a free trial for 30 days (“Free Trial for 30 Days”) or a discount for 3 months of service (“Discount”) (collectively, the “QuickBooks Offer”). QuickBooks Live Bookkeeping is not included in the QuickBooks Offer.

Free Trial for 30 Days: First thirty (30) days of subscription to the QuickBooks Products, starting from the date of enrollment is free. To continue using the QuickBooks Products after your 30-day trial, you’ll be asked to present a valid credit card for authorization. Thereafter, you’ll be charged on a monthly basis at the then-current fee for the service(s) you’ve selected until you cancel. To be eligible for this offer you must sign up for the free trial plan using the “Try it free” option.

Discount: Discount applied to the monthly price for the QuickBooks Products is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price.To be eligible for this offer you must be a new QuickBooks customer and sign up for the monthly plan using the “Buy Now” option.

Offer Terms: Your account will automatically be charged on a monthly basis until you cancel. If you add or remove services, your service fees will be adjusted accordingly. Sales tax may be applied where applicable. This offer can’t be combined with any other QuickBooks offers. Offer only available for a limited time and to new QuickBooks customers.

Cancellation: To cancel your QuickBooks Products subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your QuickBooks Online cancellation will become effective at the end of the monthly billing period. The QuickBooks Online Payroll subscription will terminate immediately upon cancellation.You will not receive a pro-rated refund; your access and subscription benefits will continue for the remainder of the billing period.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

**Features

Annual percentage yield: The annual percentage yield ("APY") is accurate as of July 31, 2023, and may change at our discretion at any time. The listed APY will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside an envelope will not earn interest. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes. Money in Envelopes must be moved to the available balance in your primary account before it can be used. Envelopes within your primary account, will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be distributed to each Envelope in proportion to the average daily balance of each Envelope.

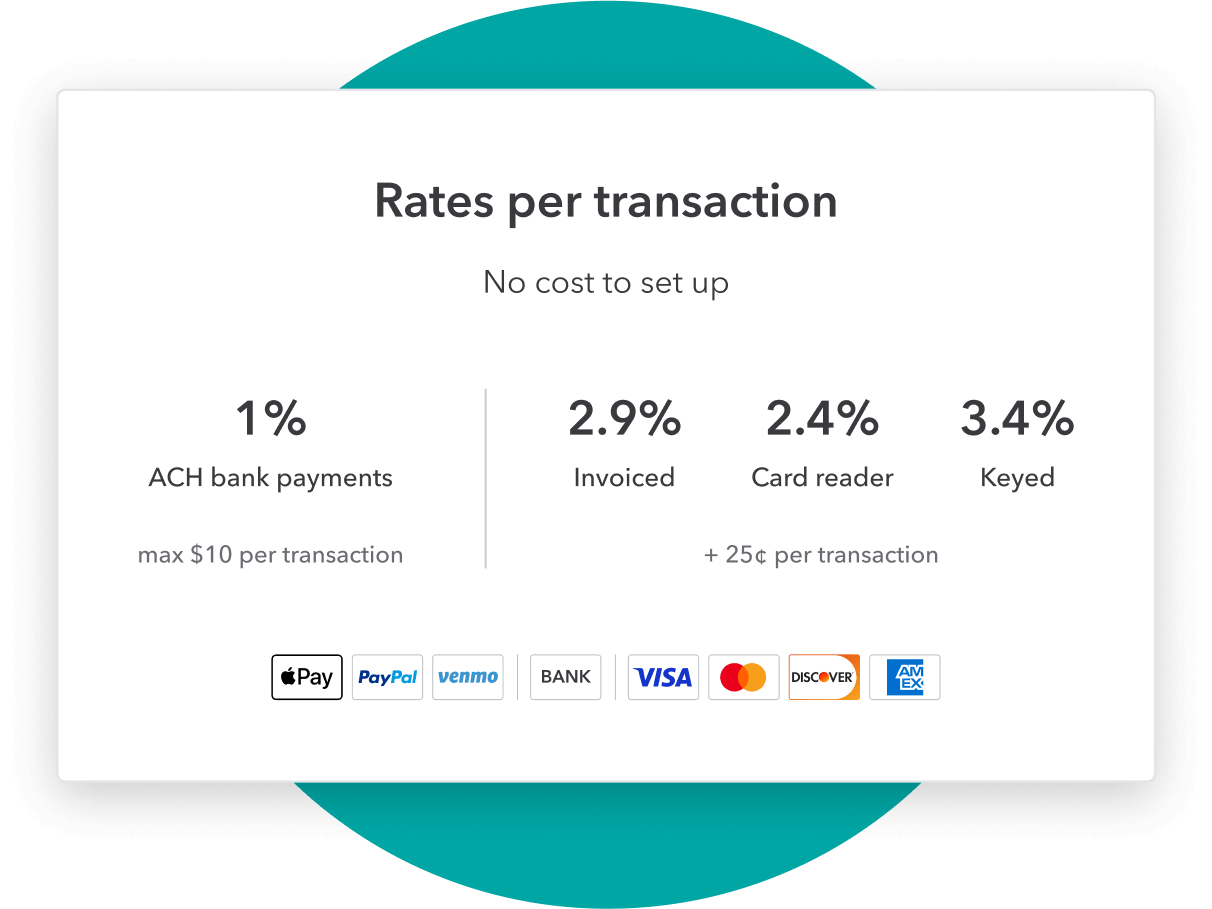

Instant Deposit: Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria, including delayed eligibility for new users and availability for only some transactions and financial institutions. The service carries a 1% fee in addition to standard rates for ACH, swiped, invoiced, and keyed card transactions. This 1% fee does not apply to payments deposited into a QuickBooks Checking account. Deposits are sent to the financial institution or debit card that you have selected to receive instant deposits. Scheduled instant deposits are run automatically; QuickBooks checks for eligible funds up to 5 times per day. Non-scheduled instant deposits are sent within 30 minutes. Transactions between 2:15 PM PT and 3:15 PM PT are excluded and processed next day. Deposit times may vary due to third party delays.

Cash flow planner: Cash flow planning is provided as a courtesy for informational purposes only. Actual results may vary.

Mileage tracking: Mileage tracking is only available to the master administrator of the QuickBooks Online account. Requires QuickBooks Online mobile (“QBM”) application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

Third party apps: Third party applications available on apps.com. Subject to additional terms, conditions, and fees.

QuickBooks Time Mobile: The QuickBooks Time mobile app works with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Time mobile access is included with your QuickBooks Online Payroll Premium and Elite subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

**Product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank.

QuickBooks Payments: Payments' Merchant Agreement applies. QuickBooks Payments account subject to credit and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.

QuickBooks Online System Requirements: QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended). Network fees may apply.

Call sales: 1-877-683-3280

© 2023 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Mint, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions.