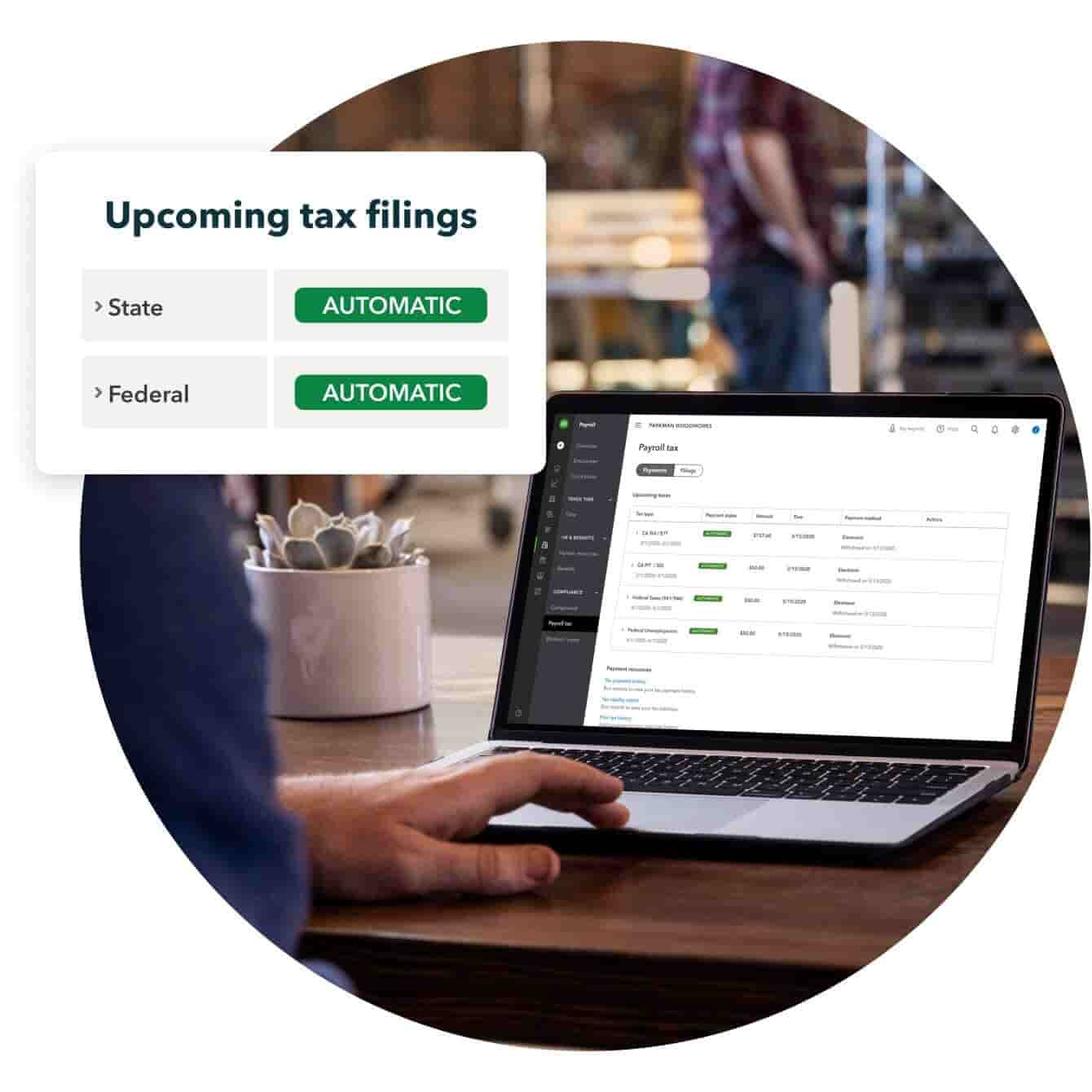

Worry-free taxes

We'll calculate, file, and pay your state and federal payroll taxes for you.**

Experts on your side

An expert can review or complete your setup, so you can start paying your team fast.**

Benefits beyond payroll

Find HR resources and offer benefits like workers’ comp, 401(k) plans, and healthcare.**

Start off strong with the right payroll plan

1

Select your payroll plan

2

Add accounting

3

Checkout

Payroll Core

Pay your team and get payroll taxes done for you. Time not included.

Save 50% for 3 months*

+$6/employee/mo

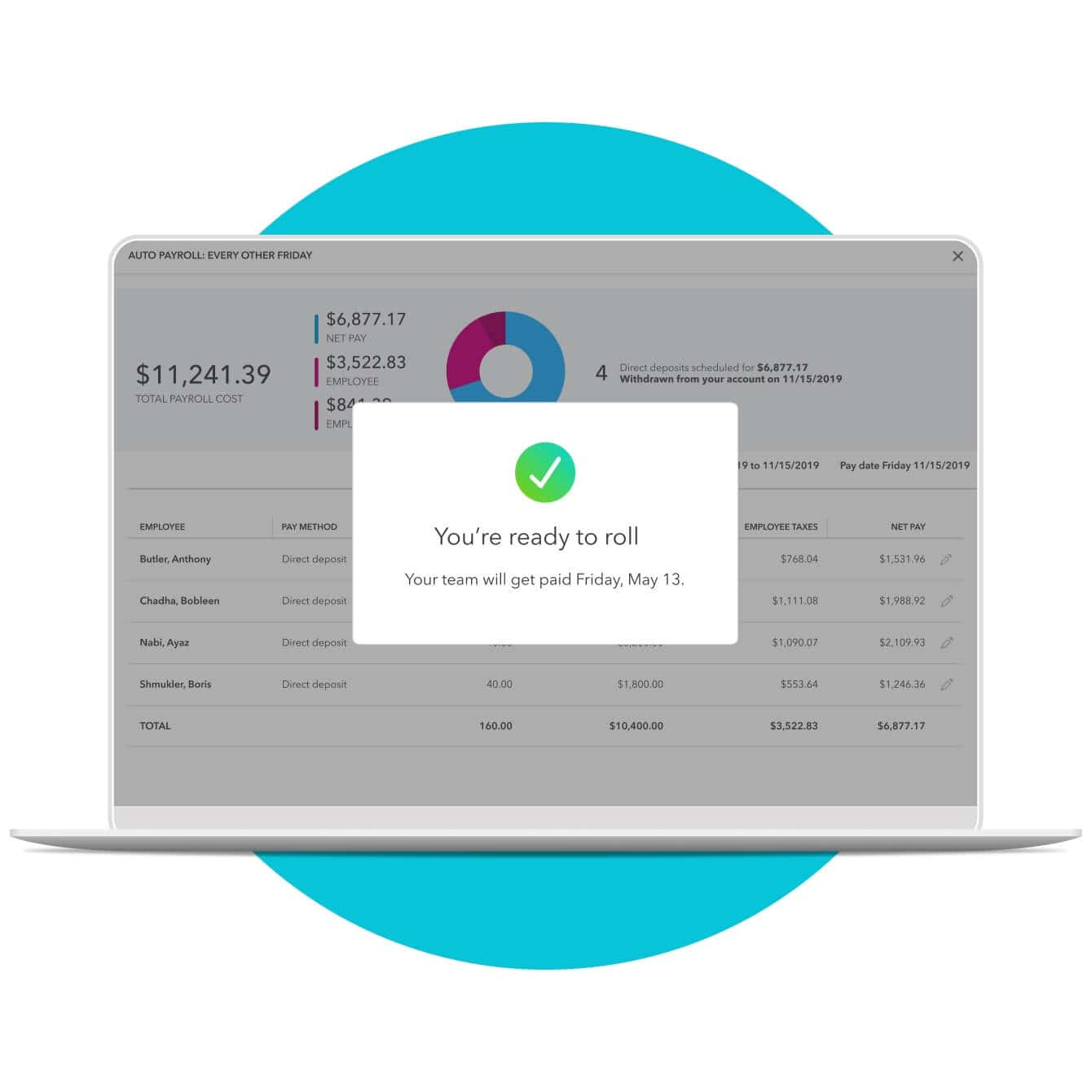

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Expert product support

Get step-by-step help, troubleshooting assistance, tips, and resources via phone or chat.**

Next-day direct deposit

Offer fast direct deposit for your team.

Take care of your team

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by SimplyInsured.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Workers’ comp administration

Save money and get coverage for on-the-job injuries with a policy by AP Intego.**

Payroll Elite

Access on-demand experts and tax protection. Includes Time Elite.

Save 50% for 3 months*

+$10/employee/mo

Take care of payday

Full-service payroll

We’ll calculate, file, and pay your payroll taxes for you and more.

Includes automated taxes & forms

Auto Payroll

Run Auto Payroll for salaried employees on direct deposit. Review, approve, or edit payroll before payday.**

1099 E-File & Pay

Create and e-file unlimited 1099-MISC and 1099-NEC forms.

Expert product support

Get step-by-step help, troubleshooting assistance, tips, and resources via phone or chat.**

Same-day direct deposit

Pay employees faster, for free. Submit payroll up to the morning of payday.

24/7 expert product support

Get troubleshooting assistance, tips, and resources from payroll support experts by phone, chat, or video.**

Expert setup

A payroll expert will complete your setup for you.**

Tax penalty protection

We’ll pay up to $25,000 if you receive a payroll tax penalty.**

Personal HR advisor

Get professional help on critical HR issues and custom handbooks and policies, powered by Mineral, Inc.**

Take care of your team

Health benefits for your team

Offer affordable medical, dental, and vision insurance packages by SimplyInsured.**

401(k) plans

Access affordable retirement plans by Guideline that sync with QuickBooks Payroll.**

Workers’ comp administration

Save money and get coverage for on-the-job injuries with a policy by AP Intego.**

HR support center

Mineral Inc offers customized job descriptions and best practices on everything from hiring to performance.**

Take payroll off your plate

Get payroll that's accurate, automatic, and easy to use. Pay employees fast with direct deposit and manage hours and projects with time tracking.**

Get payroll taxes done for you

We'll do your payroll taxes so you're never caught off guard. With tax penalty protection, we'll also pay up to $25,000 if you receive a penalty fee.**

Do it all with QuickBooks Online

Your bank and credit card transactions automatically sync so you can manage your books, pay your team, and file payroll taxes in one place.

Customer success stories

Customer success stories

“It’s so easy to stay organized with QuickBooks, instead of being across a bunch of different products and trying to keep track of everything manually.”

Jonathan Snyder, Parkman Woodworks